webAI and MacStadium(link is external) announced a strategic partnership that will revolutionize the deployment of large-scale artificial intelligence models using Apple's cutting-edge silicon technology.

Since 2020, marketing APIs evolved and expanded as the martech industry changed dramatically. Covid-19 made digital marketing more important than ever. New powerhouse ad platforms such as TikTok emerged to dominate the scene. Apple iOS 14 forced API updates and upended digital marketing strategies. In this environment, the number of marketing APIs and API updates ballooned higher. Just consider the five marketing APIs with the most updates since 2020:

If you’re a developer that uses these marketing APIs, you’ve had to deal with 125 API updates since 2020. With such fast-changing APIs, scattered documentation, and high organizational expectations, developers have been up to their necks in implementing and maintaining marketing APIs.

The Developer’s Reference Guide to Marketing APIs: 2021 Version Benchmarks & Stats is Rivery’s new developer benchmark report for marketing APIs. By pairing anonymized, aggregated customer data from hundreds of businesses with open-source documentation, the Reference Guide benchmarks how top companies are using and implementing marketing APIs. Here are our top findings from the report.

Facebook Ads is the most popular marketing API among our sample set. With 2.7 billion users(link is external), and a 3.9% CTR(link is external) for ads, Facebook remains the premier ad network for B2C and increasingly B2B. Google’s API rankings are skewed because developers must pull data from many different APIs. But with the AdWords API (position two) sunsetting in 2022, the Google Ads API (position three) will absorb many of those AdWords users, and should draw much closer to Facebook’s top spot.

The most interesting entry on this list is Bing, at position four. Bing is the second largest search engine after Google, but only claims 2.71% of the global market share(link is external). However, Bing’s average CPC is 70% lower(link is external) than Google AdWords, and Bing ads reach 63 million users(link is external) who do not use Google. LinkedIn Ads rounds out the list at position five. LinkedIn saw its ad reach grow by 25 million people(link is external) in Q4 2020, when the height of the COVID pandemic and remote work made digital marketing even more essential.

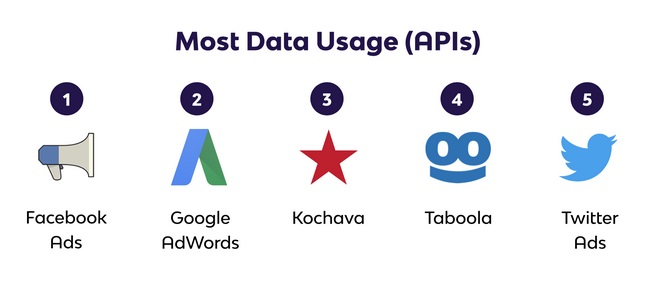

No shocker: the Facebook Ads API claims the most data usage. In position two is Google Adwords, but curiously, Google Ads did not come close to ranking on this list. To quantify the disparity, Google Adwords experienced 569% higher data usage than Google Ads. And yet Google Ads is the third most popular API, by the number of companies using it. This tells us something: companies are integrating Google Ads to prepare for the sunsetting of AdWords, but the bulk of the data is still coming from the AdWords API.

Kochava, at position three, is an interesting entry. Kochava is a mobile app attribution and analytics platform. Only a handful of sampled companies use the Kochava API, but those who do rely on it very heavily. The omni-channel platform integrates data from various marketing sources, so instead of pulling from multiple APIs, customers can leverage just the Kochava API for marketing data. The Taboola API maintains a similar dynamic: the number of users is lower, but those who use it do so exceedingly. Twitter Ads, the last API on the top data usage list, has a large number of companies who use the data source moderately.

In an interesting twist, Klaviyo, an SMS and email automation platform for ecommerce, is the most frequenttly pulled API of the sample set. Klaviyo's events is the fifth most frequently pulled report across all APIs. Customers who use Klaviyo need fresh data to generate conversions. Also notable, in the second position, is the Google Play API. A handful of accounts are using its agg report very frequently, skewing the API results.

As the third most frequently pulled API, TikTok’s position is driven primarily by the ad_groups_report, the second most frequently pulled report. However, the rest of the TikTok’s reports are in the medium-frequency to low-frequency range. The Facebook Social API appears at position four, driven by the fb_social report. SnapChat Ads rounds out the API list at position five, due to the ad_stats and ad_squad_stats report.

Marketing APIs Are Changing Faster Than Ever. Developers Need a Scalable Process to Keep Up.

Marketing APIs are changing faster than ever before. These API benchmarks show how companies are accessing marketing data via API, so developers can plan their resource investments. But In order to keep up with the market, developers need not just API benchmarks, but a scalable process for updating marketing APIs.

Most data developers still manually update API connectors. However, data developers already have a full plate, as the pandemic increased workloads for 86% of IT workers(link is external). The outcome was inevitable for many developers: some API connectors were updated, others were delayed, still others were lost in the shuffle.

For most companies, keeping up with these API updates requires a full team of data engineers, ETL platforms, or some mixture of analysts/engineers and tooling. As marketing APIs continue to change, each company must develop a scalable process to keep up with the fast-moving market — while also referencing API benchmarks to maximize resource investments.

Industry News

Development work on the Linux kernel — the core software that underpins the open source Linux operating system — has a new infrastructure partner in Akamai. The company's cloud computing service and content delivery network (CDN) will support kernel.org, the main distribution system for Linux kernel source code and the primary coordination vehicle for its global developer network.

Komodor announced a new approach to full-cycle drift management for Kubernetes, with new capabilities to automate the detection, investigation, and remediation of configuration drift—the gradual divergence of Kubernetes clusters from their intended state—helping organizations enforce consistency across large-scale, multi-cluster environments.

Red Hat announced the latest updates to Red Hat AI, its portfolio of products and services designed to help accelerate the development and deployment of AI solutions across the hybrid cloud.

CloudCasa by Catalogic announced the availability of the latest version of its CloudCasa software.

BrowserStack announced the launch of Private Devices, expanding its enterprise portfolio to address the specialized testing needs of organizations with stringent security requirements.

Chainguard announced Chainguard Libraries, a catalog of guarded language libraries for Java built securely from source on SLSA L2 infrastructure.

Cloudelligent attained Amazon Web Services (AWS) DevOps Competency status.

Platform9 formally launched the Platform9 Partner Program.

Cosmonic announced the launch of Cosmonic Control, a control plane for managing distributed applications across any cloud, any Kubernetes, any edge, or on premise and self-hosted deployment.

Oracle announced the general availability of Oracle Exadata Database Service on Exascale Infrastructure on Oracle Database@Azure(link sends e-mail).

Perforce Software announced its acquisition of Snowtrack.

Mirantis and Gcore announced an agreement to facilitate the deployment of artificial intelligence (AI) workloads.

Amplitude announced the rollout of Session Replay Everywhere.

Oracle announced the availability of Java 24, the latest version of the programming language and development platform. Java 24 (Oracle JDK 24) delivers thousands of improvements to help developers maximize productivity and drive innovation. In addition, enhancements to the platform's performance, stability, and security help organizations accelerate their business growth ...