Check Point® Software Technologies Ltd.(link is external) announced that its Infinity Platform has been named the top-ranked AI-powered cyber security platform in the 2025 Miercom Assessment.

Application Programming Interfaces (APIs) are a critical component of software development and allow developers to build applications and microservices more rapidly. The second annual RapidAPI Developer survey (conducted at the end of 2020) asked 1500 developers, executives, and engineering managers about their API usage and other technology trends. The survey found API adoption increased across all industries, with executives prioritizing investments in the API economy.

Developers Across All Industries Used More APIs in 2020 ...

The survey confirms what many developers already expected to see — API usage continues to grow at a rapid rate.

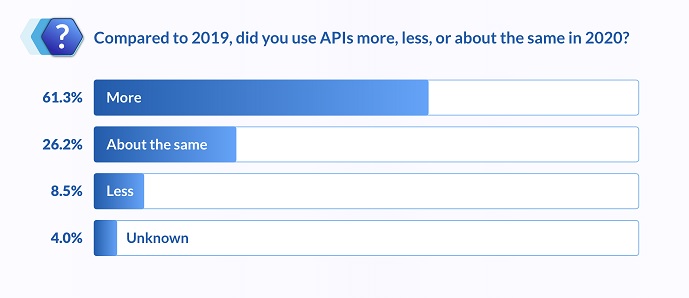

61.3% of respondents used more APIs in 2020 compared to 2019. An additional 26.2% reported using APIs about the same amount in 2019 and 2020.

This shows a strong interest in APIs and microservices by developers from all industries, backgrounds, and experience levels.

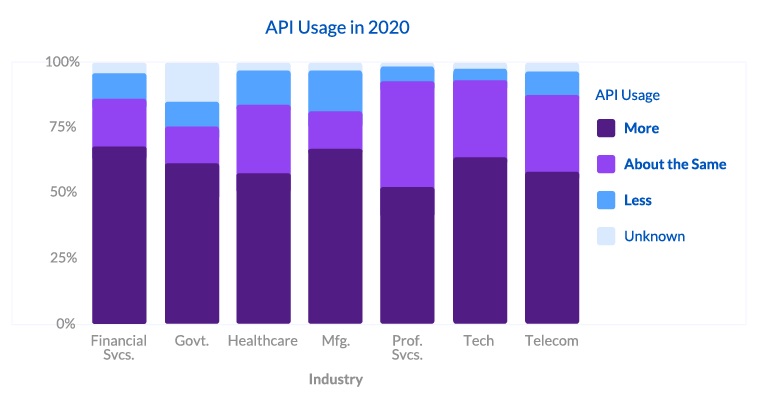

When we take a closer look at the responses, all of the industries included in the survey show increased API usage in 2020. The 3 industries with the highest percentage of developers reporting increased API usage are Financial Services (68.6%), Manufacturing (67.7%), and Technology (64.7%).

... and Expect to Use Even More APIs in 2021

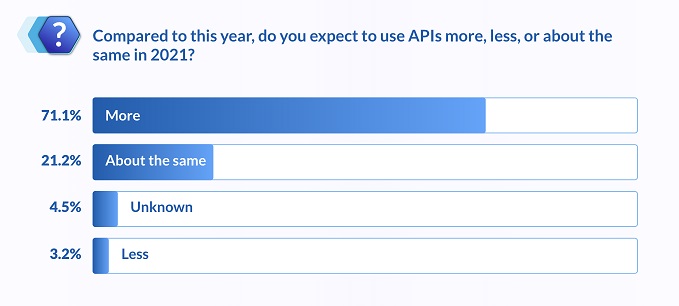

API usage is poised to grow even more throughout 2021. The survey found 71.1% of developers expect to use more APIs in 2021 than 2021, and an additional 21.2% plan to use about the same amount.

This supports the prioritization of digital transformation by many companies, which has been spurred in part by the COVID-19 pandemic and rise of remote work.

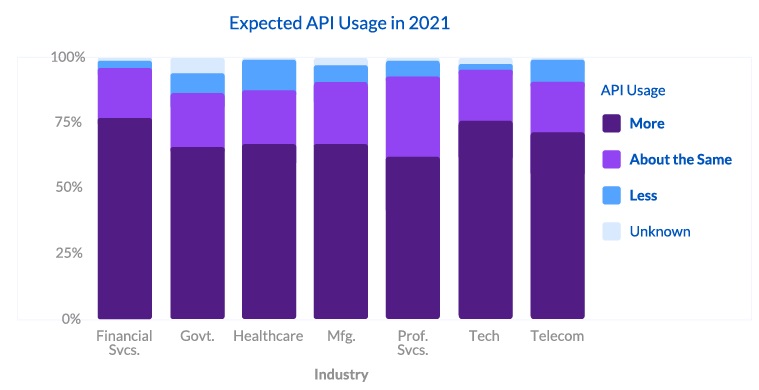

We see this overwhelming trend towards increasing API usage across all industries that were included in the survey. There is some variance if we look at the breakdown by industry.

The 3 industries with the highest percentage of developers expecting to use more APIs in 2021 compared to 2020 are Financial Services (77.3%), Technology (76.2%), and Telecommunications (71.4%).

Executives Prioritize Participation in the API Economy

It's not just developers who report increased interest and usage of APIs. Across all industries, 58% of executives in the survey said participating in the API economy was a top priority for their organization.

This number was even more prominent in certain industries including telecommunications (89%), healthcare (75%), and financial services (62%).

Executives are prioritizing involvement in the API economy for a variety of reasons, including potential profits, competitive outlook, and regulatory requirements.

For example, traditional Telcom providers have been exposing APIs to consumers and partners, in order to compete with newer companies like Twilio. This provides a potential opportunity for increasing profits and allows them to stay relevant in the changing industry landscape.

Additionally, standards and regulations are driving increasing participation in the API economy. Examples include Fast Healthcare Interoperability Resources (FHIR) and the Open API Initiative which are critical to healthcare and financial services.

These trends are likely to expand into other industries in 2021 and beyond.

Interest in New API Technologies Accelerates

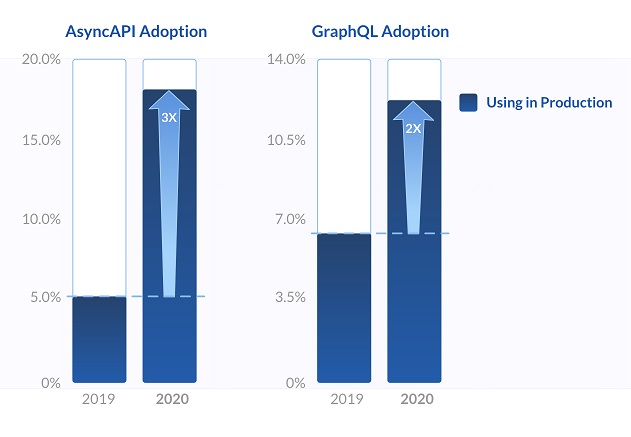

As APIs become more pervasive, interest in new API technology also grows. The 2019 and 2020 surveys both questioned participants about their usage of several established and emerging API technology trends.

Trends featured in both years of the survey include SOAP, REST, GraphQL, gRPC, and more.

Most notably, the survey saw major increases in two areas — AsyncAPIs and GraphQL. The number of developers using AsyncAPIs in production more than tripled from 5% in 2019 to over 19% in 2020. Likewise, the number of developers using GraphQL doubled from 6% in 2019 to 12% in 2020.

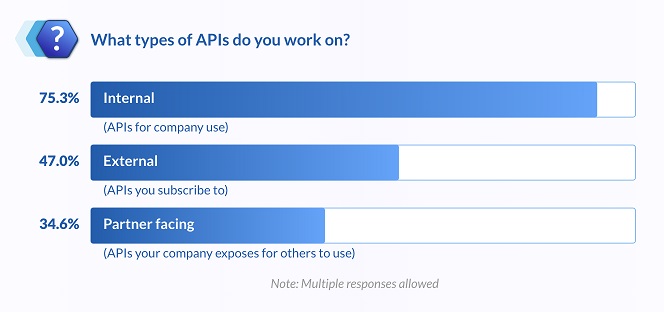

Increased Investment in Developing Internal APIs

Companies aren't just investing resources to expose APIs for consumers and partners — there is also growing investment in developing internal APIs and microservices.

The survey found nearly 40% of the largest organizations have over 250 internal APIs. On top of this, 75% of developers reported working on internal APIs for their organization. This was a larger percentage than the developers who reported working on external APIs (47%) or partner-facing APIs (34%).

With nearly 60% of developers spending 10 or more hours a week working on APIs, it is clear organizations are investing a significant amount of time and resources to develop internal APIs.

Key Takeaway

If 2020 proved one thing — it's that the road ahead is unpredictable and uncertain. It also proved that APIs and microservices are here to stay, and continued investment in these areas will be the key for many companies as they navigate 2021 and beyond.

Industry News

Orca Security announced the Orca Bitbucket App, a cloud-native seamless integration for scanning Bitbucket Repositories.

The Live API for Gemini models is now in Preview, enabling developers to start building and testing more robust, scalable applications with significantly higher rate limits.

Backslash Security(link is external) announced significant adoption of the Backslash App Graph, the industry’s first dynamic digital twin for application code.

SmartBear launched API Hub for Test, a new capability within the company’s API Hub, powered by Swagger.

Akamai Technologies introduced App & API Protector Hybrid.

Veracode has been granted a United States patent for its generative artificial intelligence security tool, Veracode Fix.

Zesty announced that its automated Kubernetes optimization platform, Kompass, now includes full pod scaling capabilities, with the addition of Vertical Pod Autoscaler (VPA) alongside the existing Horizontal Pod Autoscaler (HPA).

Check Point® Software Technologies Ltd.(link is external) has emerged as a leading player in Attack Surface Management (ASM) with its acquisition of Cyberint, as highlighted in the recent GigaOm Radar report.

GitHub announced the general availability of security campaigns with Copilot Autofix to help security and developer teams rapidly reduce security debt across their entire codebase.

DX and Spotify announced a partnership to help engineering organizations achieve higher returns on investment and business impact from their Spotify Portal for Backstage implementation.

Appfire announced its launch of the Appfire Cloud Advantage Alliance.

Salt Security announced API integrations with the CrowdStrike Falcon® platform to enhance and accelerate API discovery, posture governance and threat protection.

Lucid Software has acquired airfocus, an AI-powered product management and roadmapping platform designed to help teams prioritize and build the right products faster.

StackGen has partnered with Google Cloud Platform (GCP) to bring its platform to the Google Cloud Marketplace.